Global commerce increasingly depends on payment infrastructure capable of supporting instantaneous transactions across borders and time zones. Understanding blockchain architecture, particularly when evaluating the solana price relative to network performance capabilities, reveals how different platforms address varying business requirements from micropayments to institutional settlements. With blockchains now processing over 3,400 transactions per second and handling more than 100 times the transaction volume compared to five years ago, technical infrastructure has become the backbone of digital economic activity.

Contents

- 1 Transaction Throughput Requirements for E-Commerce Platforms

- 2 Network Latency Impact on Cross-Border Remittances

- 3 Blockchain Architecture Supporting Micropayments

- 4 Institutional Settlement Requirements and Infrastructure

- 5 Technology Enabling High-Speed Payment Processing

- 6 Comparing Blockchain Performance for Business Applications

- 7 Monitoring and Optimization Strategies

Transaction Throughput Requirements for E-Commerce Platforms

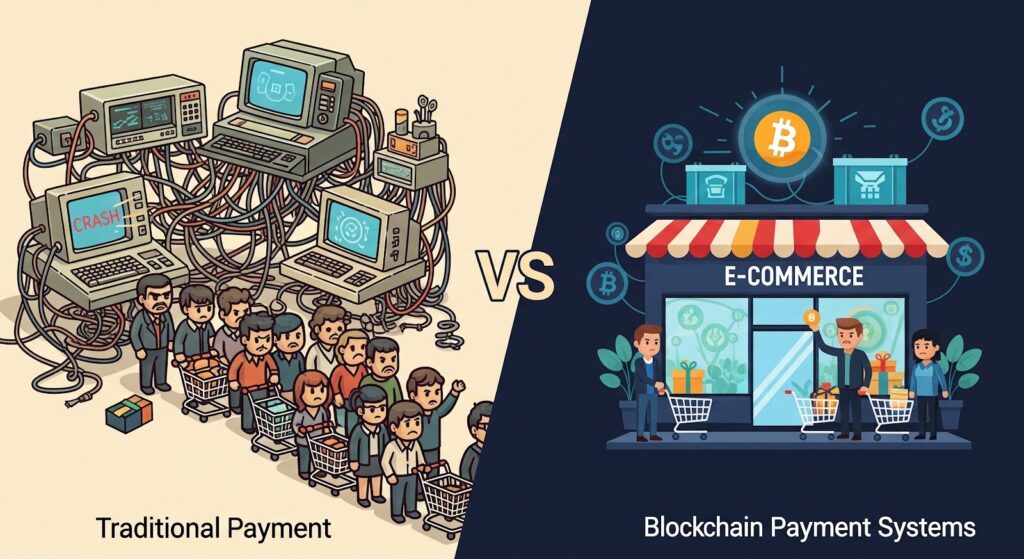

E-commerce platforms face extraordinary demands during peak traffic periods, with leading payment processors needing to handle over one million transactions per minute during major sales events. Traditional payment systems struggle under this pressure, often experiencing delays, system crashes, and failed transactions during high-demand periods like Black Friday. Modern blockchain-based payment systems offer compelling alternatives, with settlement times reduced from 1-5 business days to seconds or minutes while maintaining 24/7/365 availability regardless of banking hours.

Solana demonstrates exceptional throughput capabilities, processing up to 65,000 transactions per second in test environments while maintaining average confirmation times of just 400 to 500 milliseconds. This performance surpasses Bitcoin, which handles approximately 7 TPS, and Ethereum, which manages around 25 TPS. Real-world implementation shows Solana consistently processing over 885 transactions per second with actual recorded volumes reaching 2,400 TPS in production environments. These capabilities position high-performance blockchains as viable infrastructure for enterprises requiring rapid transaction processing without bottlenecks.

Network Latency Impact on Cross-Border Remittances

Latency directly affects user experience and operational efficiency in remittance services, where traditional systems impose 3-5 business day delays for cross-border transfers. Blockchain payment systems have transformed this landscape, reducing average cross-border transaction times to 3-10 seconds compared to the 2-5 days required by legacy banking infrastructure. This improvement stems from blockchain’s ability to simultaneously handle the messaging layer and money movement layer, effectively replacing both SWIFT messaging and correspondent banking networks.

Remittance companies have recognized these advantages, with approximately 40% now utilizing blockchain technology for cross-border transfers to gain speed and cost efficiency. Africa experienced a 60% surge in blockchain payment adoption during 2025, driven primarily by demand for cheaper and faster remittance rails. The cost differential proves equally compelling—traditional cross-border payments through banks charge 2-7% when accounting for transfer fees, foreign exchange spreads, and intermediary charges, while blockchain payments reduce cross-border fees to just 0.1-2%.

Blockchain Architecture Supporting Micropayments

Micropayment infrastructure requires fundamentally different technical specifications than large-value transfers, prioritizing low transaction costs over maximum security features. Traditional cryptocurrency exchanges typically charge fees that make micropayments economically unviable, for instance, Coinbase charges $0.99 for transactions up to $10, effectively eliminating profit margins for small-value transactions. Blockchain networks designed specifically for high throughput address this challenge through innovative consensus mechanisms and optimized architectures.

Solana employs Proof of History combined with Proof of Stake to achieve transaction fees below $0.0025, making micropayments economically feasible while maintaining high security standards. The average transaction cost on Solana stands at approximately $0.00026, several orders of magnitude lower than Ethereum’s typical fees. This cost structure enables viable business models for digital content, pay-per-use services, and microtransaction-based applications that would prove impossible on higher-fee networks. The technical architecture supporting these low costs includes parallel transaction processing and efficient consensus validation that reduces computational overhead.

Institutional Settlement Requirements and Infrastructure

Institutional financial operations demand different performance characteristics than consumer transactions, prioritizing reliability, compliance integration, and capacity for large-value transfers. Banks adopting blockchain payment systems in 2025 save up to 35% on operational costs by removing intermediaries and reducing fraud risks. Smart contracts, now utilized by 30% of global businesses, automate complex payment logic and reduce processing times by 65% compared to traditional manual reconciliation processes.

Ultra-low-latency infrastructure has become essential for institutional cryptocurrency trading, with platforms like Coinbase International Exchange implementing Amazon Aurora databases to facilitate near-real-time transaction processing. The exchange employs specialized EC2 instances within cluster placement groups to achieve the low-latency network performance necessary for tightly coupled node-to-node communication in distributed trading engines. These technical decisions directly impact market competitiveness, as latency reductions of even milliseconds can determine trading success in high-frequency environments.

Technology Enabling High-Speed Payment Processing

Multiple technological innovations converge to enable modern high-speed payment infrastructure. Fiber optic networks reduce data transmission latency by 50% compared to traditional broadband connections, while Direct Market Access eliminates intermediary platforms and cuts latency by several critical milliseconds. Edge computing processes data closer to its source, reducing the physical distance information must travel and thereby minimizing delays crucial for real-time transaction validation.

Machine learning and artificial intelligence enhance both speed and security, analyzing transaction patterns and executing automated decisions faster than human intervention allows. Payment systems utilizing real-time streaming architectures successfully flag 99% of fraudulent transactions while maintaining processing speeds necessary for peak transaction volumes. Auto-scaling capabilities allow infrastructure to dynamically adjust capacity, automatically adding server instances during traffic spikes and reducing capacity during off-peak periods to optimize cost efficiency.

Comparing Blockchain Performance for Business Applications

Different blockchain architectures serve distinct business needs, with performance characteristics varying significantly across platforms. When analyzing the solana price in context with network capabilities, businesses must consider transaction throughput, finality speed, and cost per transaction relative to their specific operational requirements. Market forecasts indicate Solana’s November 2025 pricing ranges from a minimum of $155.54 to a maximum of $163.99, with average trading values around $159.77.

Cross-chain technology adoption increased 45% in 2025, enabling seamless transactions across different blockchain platforms and allowing businesses to leverage multiple networks based on specific transaction characteristics. E-commerce platforms requiring sustained high-volume processing benefit from networks capable of handling thousands of transactions per second, while occasional large-value institutional settlements may prioritize security and regulatory compliance over raw speed. Payment system designers must balance throughput capacity, latency requirements, transaction costs, and security features when selecting blockchain infrastructure.

Monitoring and Optimization Strategies

Maintaining optimal payment system performance requires continuous monitoring of key performance indicators including transaction throughput, latency, and error rates. Modern payment infrastructure employs tools like AWS CloudWatch and Prometheus to track system health and trigger automated alerts when services show degraded performance. Redundant payment gateway integration ensures transaction continuity—if one gateway fails, transactions automatically route to alternative gateways without service interruption.

Transaction processing speed proves crucial for businesses experiencing high transaction volumes, as delayed or sluggish processing creates bottlenecks that negatively impact business scalability. Blockchain systems in 2025 reduced chargeback fraud by 80% for adopting businesses through improved transaction transparency and immutable record-keeping. The combination of real-time monitoring, automated scaling, and redundant infrastructure enables payment systems to maintain 99.99% uptime even during critical high-traffic periods.

Modern payment infrastructure supporting global commerce requires careful architectural decisions balancing speed, cost, security, and scalability. High-performance blockchains like Solana demonstrate how innovative consensus mechanisms enable micropayment viability while supporting institutional settlement needs through configurable infrastructure. As transaction volumes continue growing and businesses increasingly require instant cross-border settlement capabilities, payment system architecture becomes a competitive differentiator determining market success.