Price patterns offer visual insights into investor psychology and potential future movements in technical analysis. Among the more recognized formations, the inverse head and shoulders pattern strongly indicates bullish reversals. This setup reflects a shift in market momentum from bearish to bullish, often preceding a sustained upward trend. Traders closely monitor its formation to gauge potential entry points and improve timing. This pattern’s structure is distinctive and informative, making it a valuable tool in analyzing market sentiment.

We will explore how this formation works, its key components, and why it tends to signal a market turnaround. Understanding the pattern’s behavior across various asset classes can give traders an edge when navigating uncertain or transitional market conditions. We will explore the inverse head and shoulders trading pattern into practical takeaways and real-world implications for anyone interested in chart-based trading strategies.

Understanding the Inverse Head and Shoulders Pattern

- What the Pattern Represents

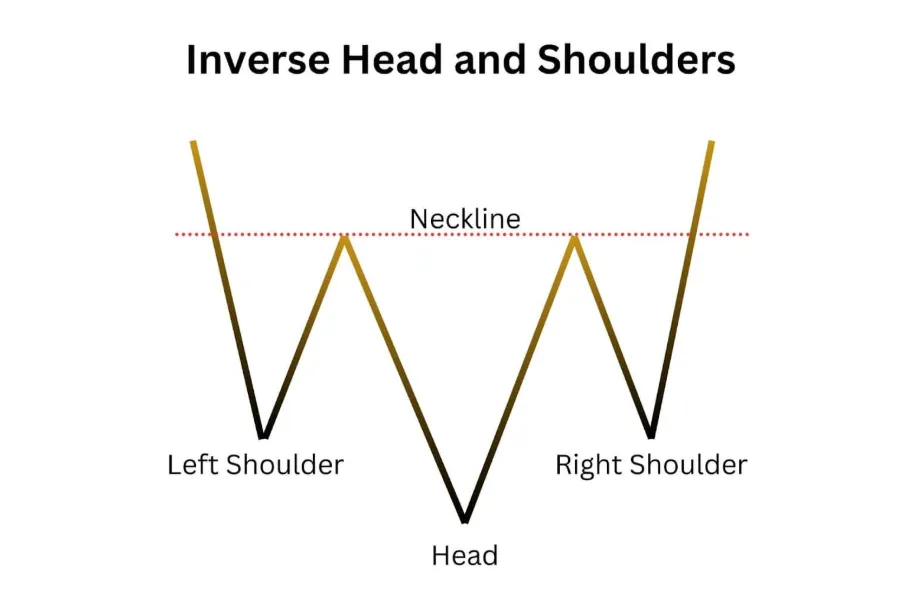

The inverse head and shoulders is a technical chart pattern representing a possible reversal from a downtrend to an uptrend. This structure typically forms after a prolonged decline, suggesting that selling pressure is subsiding and buyers are gaining control. Visually, the pattern consists of three troughs: the first and third are shoulders, roughly equal in depth, while the middle trough—the head—is the lowest point. A neckline is drawn connecting the highs of the retracements between these troughs.

Once the price breaks above the neckline, it indicates a reversal and potential new uptrend. The formation signals that bearish momentum has weakened, giving bulls the chance to initiate a rally. What sets this pattern apart is its psychological narrative: initial selling causes the first shoulder, a deeper wave of capitulation drives the head, and a failed retest creates the second shoulder, followed by increasing demand. This structure mirrors collective investor behavior, capturing fear, hesitation, and renewed confidence in a single visual.

- Why Traders Rely on This Signal

Many traders use the inverse head and shoulders as a reliable signal of trend reversals because it often precedes significant price recoveries. While no single indicator guarantees future results, this pattern has earned attention due to its frequency and clarity on charts. It offers a relatively clear framework to structure trades—entry above the neckline, a stop-loss below the second shoulder, and a target based on the height from the head to the neckline projected upward. This logical layout makes it easier for traders to manage risk and anticipate movement.

The pattern also aligns well with volume analysis; typically, the breakout above the neckline is accompanied by a noticeable increase in volume, reinforcing conviction. Traders often combine it with momentum indicators like RSI or MACD to confirm the shift in sentiment. The fact that it integrates easily with other tools adds to its appeal. The pattern maintains effectiveness across various markets and timeframes, whether applied to stocks, forex, or cryptocurrencies.

- Common Traps and Misinterpretations

While the inverse head and shoulders can be a powerful pattern, they have potential pitfalls. One common mistake traders make is anticipating the pattern too early, mistaking any three-trough structure as a valid setup. Without a clear neckline and breakout confirmation, premature entries can lead to losses. Volume confirmation is another critical factor. The signal may weaken if the neckline breaks without increasing volume, and the price could retrace quickly. Some traders also misplace the neckline, especially in patterns with slanted or uneven highs, leading to inaccurate targets or entry points.

Furthermore, not all breakouts sustain upward momentum. Sometimes, the price may retest the neckline after breaking out, which could either validate the move or result in a failed pattern. Traders must remain cautious and look for additional confluence factors before making decisions. The pattern should not be used in isolation but rather as part of a broader market analysis to improve accuracy and confidence in the trade.

- Application Across Markets and Timeframes

One of the greatest advantages of the inverse head and shoulders pattern is its adaptability. It can appear on charts ranging from five-minute intervals to monthly timeframes, making it useful for day traders, swing traders, and even long-term investors. In equities, the pattern may signal a rebound from oversold conditions or the end of a correction phase. In forex, it could indicate a shift in macroeconomic sentiment or central bank policy expectations. For cryptocurrencies, the pattern often marks the end of speculative downturns and the beginning of new hype cycles. The key is recognizing the pattern within the broader trend and market environment.

For instance, an inverse head and shoulders forming near a long-term support level adds weight to the reversal thesis. Alternatively, one appearing in isolation without fundamental support may carry less conviction. The pattern’s flexibility allows traders to tailor their strategies depending on market behavior and risk appetite. It’s not about the timeframe but context, confirmation, and execution.

The inverse head and shoulders pattern remains one of the more telling signs of bullish reversals in financial markets. Its distinct structure offers insights into shifts in sentiment and provides a visual framework for planning trades. While not infallible, it presents an opportunity to anticipate potential turnarounds more confidently when used with other tools and careful analysis. Its adaptability across markets and timeframes ensures that new and seasoned traders can apply it to suit their strategy. Most importantly, approaching it with discipline and context allows the pattern to become more than a visual signal—it becomes a key part of navigating changing market landscapes.